ARK Invest

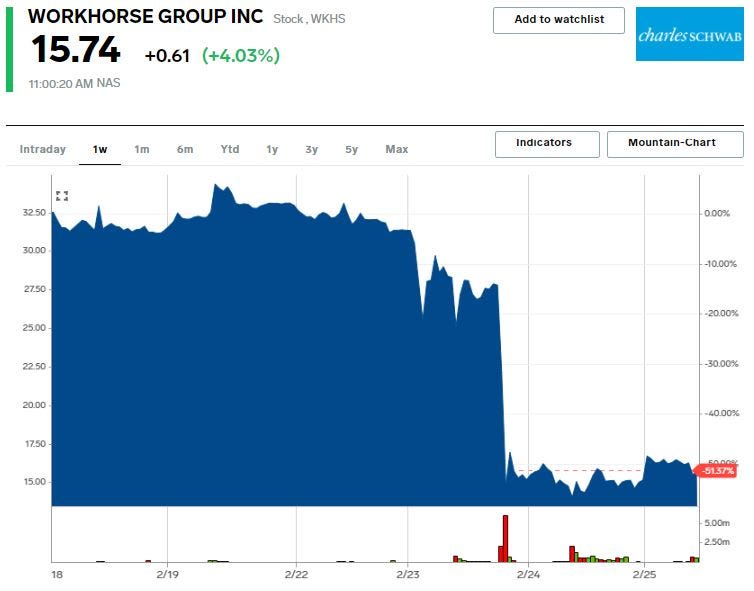

- Cathie Wood’s Ark Invest was not fazed by the more than 50% decline in shares of Workhorse Group this week.

- The ARK Autonomous Technology and Robotics ETF bought 660,500 shares of Workhorse on Wednesday.

- Workhorse rallied as much as 9% in Thursday trades, but shares are still down significantly after the company lost out on a contract with the US Postal Service to rival Oshkosh.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Cathie Wood’s Ark Invest viewed the more than 50% decline in shares of Workhorse Group this week as a an opportunity to buy the dip, evidenced by the firm’s purchase of shares on Wednesday.

Shares of Workhorse jumped as much as 9% in Thursday trades as Ark Invest disclosed in its daily trading e-mail that the firm’s Autonomous Technology and Robotics ETF purchased 660,500 shares of the EV company.

Workhorse Group plunged on Tuesday after it was revealed that a US Postal Service contract to electrify its fleet of trucks was awarded to rival Oshkosh. The contract could have represented more than $5 billion in potential revenue for Workhorse, according to an analysis from Bloomberg.

For a time, the electric vehicle maker Workhorse was thought to be a leader in the competition for the lucrative contract. The USPS commissioned five prototype postal service vehicles and Workhorse partnered with truck builder VT Hackney to produce their own.

But the ARK ETF’s purchase, worth about $10 million on Thursday, is a small bet relative to the fund’s other positions. Workhorse represents 0.25% of the fund, while top holding Tesla had a 10.5% weight in the ETF.

Workhorse has since pared gains and is trading up 2% as of 11:05 a.m.